Although the tax season is over, we do occasionally still have clients coming in because they received a letter from the Internal Revenue Service or from the Department of Revenue demanding that they go online and verify their identity. Specifically, they are asked to go to a specific website and take an identity test. I probably should have blogged about this during the tax season, but I was busy. I anticipate that people will be receiving more such letters next year, so it is important that I get this online. I will probably repost it in the middle of the next tax season.

Although the tax season is over, we do occasionally still have clients coming in because they received a letter from the Internal Revenue Service or from the Department of Revenue demanding that they go online and verify their identity. Specifically, they are asked to go to a specific website and take an identity test. I probably should have blogged about this during the tax season, but I was busy. I anticipate that people will be receiving more such letters next year, so it is important that I get this online. I will probably repost it in the middle of the next tax season.

The reason that people are receiving these letters is because tax refund identity theft is a huge problem. The Internal Revenue Service admits that it paid over $5 billion in refunds on fraudulent tax returns filed for the 2013 tax year. That is to say that the Internal Revenue Service itself acknowledges that it paid $5 billion on tax returns that it is now aware were filed by people who were not the taxpayer, but instead fraudsters who stole the taxpayer’s identity. No doubt, they paid out several billion dollars more to people where they are still fighting with the true taxpayer over whether or not they have received their refund. With the Turbo Tax problems which occurred earlier in the tax season, the 2014 number is certain to be higher.

It happens to all kinds of people. It has actually happened to my own parents. A few years ago they filed a tax return and were told by the Internal Revenue Service that they had already filed their tax return and had already received a refund. It took them several months of fighting with the Internal Revenue Service to convince the Internal Revenue Service that they were who they are, and that the refund that they paid was fraudulently obtained. In an effort to combat tax refund identity theft, the Internal Revenue Service and the Department of Revenue has each come up with a system of asking people to verify their identities.

The website for the Internal Revenue Service is https://idverify.irs.gov/IE/e-authenticate/welcome.do

The website for the Department of Revenue is https://www.mass.gov/dor/quiz

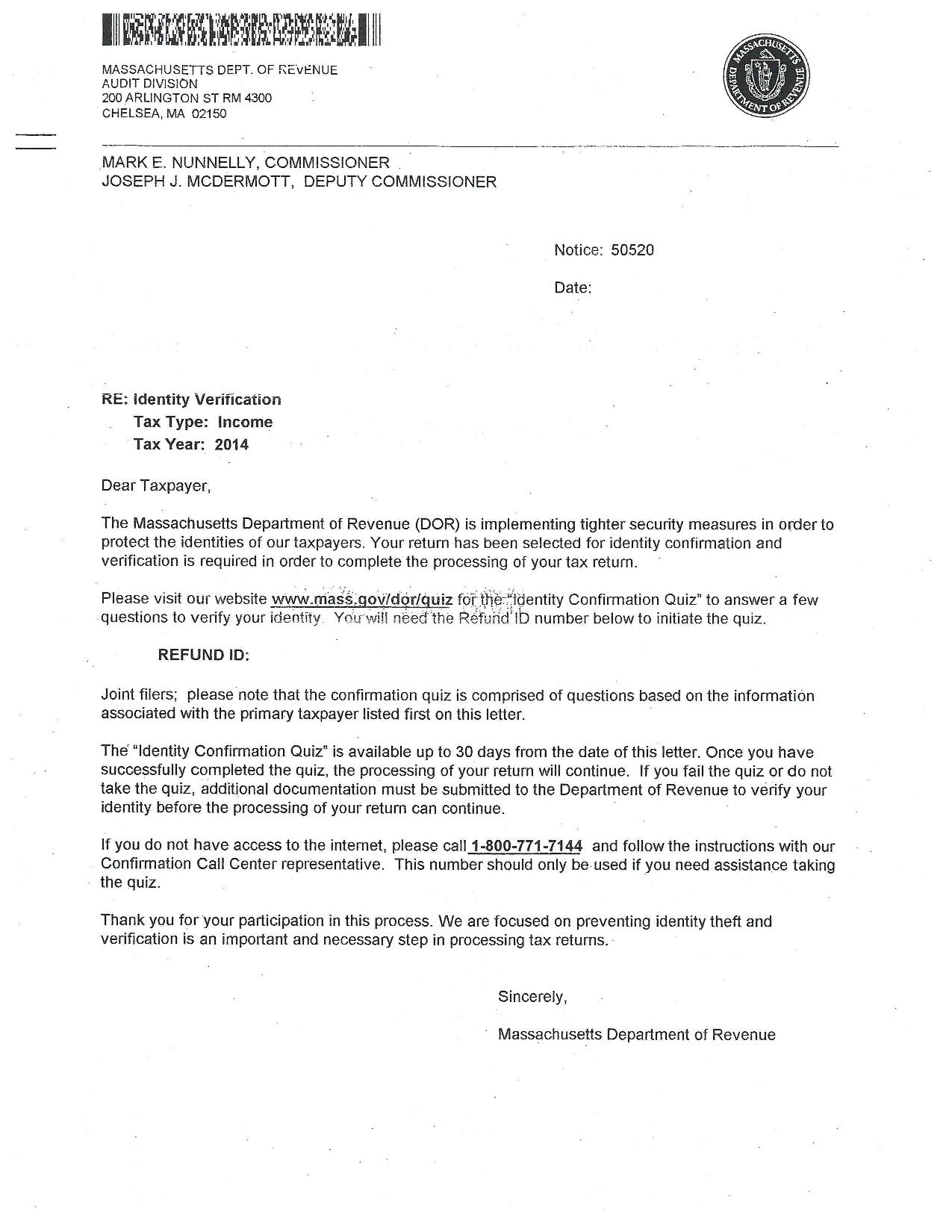

I feel bad that I did not ask clients who came in for help with this to let me copy their letters. However, I did have someone come for help a few weeks ago who had received a Department of Revenue letter. The tax season was over, so it occurred to me that I should ask for a copy for this blog. A redacted copy of the letter is attached and I thank my client for letting me copy this. The important thing to note is that the Internal Revenue Service testing site is at irs.gov and the Department of Revenue’s site is at mass.gov. Websites with irs.gov before all the slashes are official Internal Revenue Service websites. Websites that have mass.gov/dor are official Department of Revenue websites. However, if you are not that comfortable with how websites are designed and organized, and you are a client of mine, then bring your letter to the office and we will help you to figure out if the letter is legitimate or not.

The Internal Revenue Service and Department of Revenue each claim to have a computer algorithm that helps them to determine which tax returns to verify. In some cases, I have observed that they ask questions about relatives who themselves have been the victims of identity theft. In other cases, I think the selection is probably random. Either way, the “test” is not a big deal, so long as you have verified that the website is legitimate. Obviously, you do not want to give personal information to a sham website. This is why we do not mind reviewing these letters when our clients give them to us.