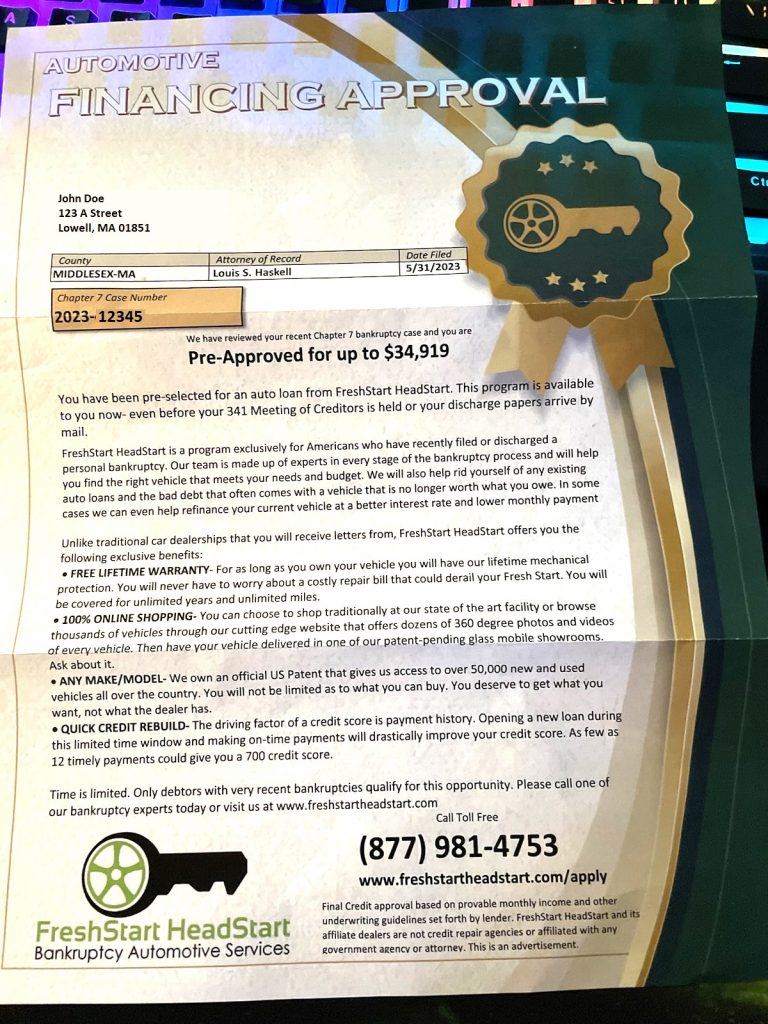

A client of mine sent me the attached solicitation today. She wanted to know if this was legitimate. It is probably a legitimate solicitation if that is a thing. It is not associated with the bankruptcy court.

There are companies that sell lists of contacts to marketers. Among the lists that they sell are people who have recently filed for bankruptcy. These lists are sold to banks, credit card companies, auto loan and mortgage lenders and other companies that lend money. People who have filed for bankruptcy are appealing to some creditors for several reasons. One is that they are among the few people in America who have no debt. Another reason is that it is necessary to put eight years between Chapter 7 bankruptcy filings, so such a borrower is limited in their creditor defenses. Also, as such people believe they are ineligible for credit, they are very anxious to sign up with anyone who will offer them credit. While I have no idea if this company is good, bad or indifferent, I do know that my clients often receive solicitations shortly after filing for credit cards, personal loans and especially automobile loans.

I would point out that in this case the bankruptcy was filed in May and the solicitation was sent in August. The potential creditor is expecting the discharge to be issued soon and thus my client to be eligible to start borrowing again. I will advise my client to reach out to the bank or credit union that she already deals with or to let the dealer try to find her financing if she needs to purchase a new vehicle now. If she wants to do business with this company, I encourage her to do her research online first. This company has very few Internet reviews, although it does have a 100 “trust score” on scamadvisorher.com. Monica, Google’s AI, says that they are trustworthy for what that is worth.