Help! I Got a Letter from the IRS: A Lowell Attorney’s Guide to "Containment"

If you get a letter from the IRS, do not call them yourself.

You can accidentally expand the audit by oversharing.

Bring the letter to a Tax Attorney immediately to preserve your appeal rights and keep the issue contained

Why “being helpful” to an auditor is the fastest way to double your tax bill

If you just opened your mailbox…

Maybe it’s a CP2000 Notice…

Your instinct is probably to call them…

Stop. Do not pick up the phone.

I am a Tax Attorney in Lowell. I have spent decades standing between my neighbors and the IRS.

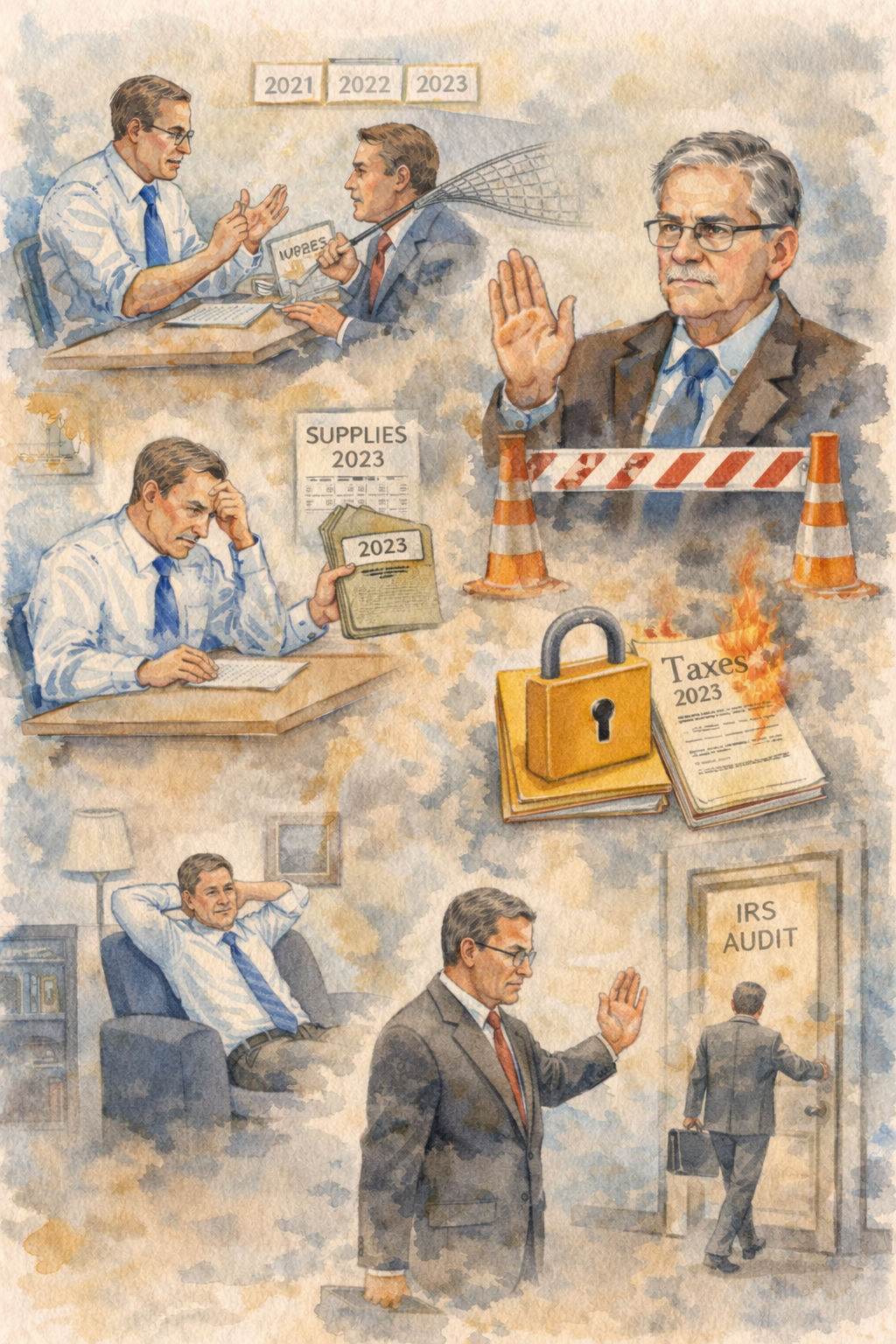

The “Ticking Clock” of Appeals

The IRS actually has a very good in-house administrative appeals process. It is fair, and it works.

I have resolved countless cases by talking to an Appeals Officer — getting results that the front-line auditor refused to give.

But this system runs on a deadline.

Every letter you ignore burns a bridge:

If you ignore the first letter, you lose the easy fix.

If you ignore the “Notice of Deficiency,” you lose your right to go to Tax Court without paying the tax first.

If you ignore the “Collection Due Process” letter, you lose your right to stop them from seizing your bank account.

I recently had a client who ignored the letters until the very end. The administrative appeals doors were locked. I had to file a Tax Court Petition just to get someone to listen. We fixed it, but it was a nuclear option for what should have been a diplomatic conversation.

The lesson: The earlier you call me, the more weapons I have to fight with.

The “Self-Incrimination” Trap

Why do I say “Tax lawyers never bring their clients to an audit”?

Because clients talk. And when clients talk, they accidentally confess.

Here is a classic example:

An auditor challenges a deduction for daily meals with the same employee. They think it’s unreasonable.

The taxpayer says:

“Oh, I’ve been taking that same deduction for years and no one ever said anything!”

You just handed the auditor a loaded gun.

You just invited them to open up the last three years of your tax returns. You turned a one-year inquiry into a multi-year investigation.

Here is another one:

The auditor asks about a receipt.

The taxpayer says:

“To be honest, my bookkeeping is dreadful, I just kind of guess at the numbers.”

Game over.

You just admitted your records are unreliable. The auditor can now throw out every number on your return — not just the one they were asking about.

My Strategy: "Containment"

When I represent you, you stay home.

I deal with the IRS directly—by phone, mail, or in person.

My job is simple: Containment.

That means we answer only the question they asked—nothing more.

If the audit is about “Supplies in 2023,” we talk about Supplies in 2023.

If the auditor starts asking about 2022, I shut it down.

If they suddenly ask about your car when the audit is about your office, I shut it down.

Because IRS audits have one major danger: scope creep.

A small question turns into a bigger investigation—unless someone knows how to stop it.

I’m a trial lawyer. I know the rules. I know what the IRS is allowed to ask, and what’s just a fishing expedition.

And here’s the part most people don’t realize:

As long as you have a representative, the IRS cannot force you to be there.

Use that right.