The Lowell Landlord’s Tax Guide: Repairs, Recapture, and the “Time Bomb” of Cheap Tax Prep

Lowell is a city of landlords. From triple-deckers in the Highlands to multi-families in Centralville, rental property is one of the main ways families here build long-term wealth.

But rental property taxes are not “basic tax prep.”

And the biggest danger I see is this:

a preparer who doesn’t understand rental rules can accidentally create a future IRS problem—without you knowing it.

I’m a Tax Attorney and Enrolled Agent in Lowell, and here are the four “silent mistakes” that cost landlords the most.

The “Six-Figure Letter” After a Home Sale

The mistake:

A homeowner sells a property and the sale is either:

left off the tax return, or

reported incorrectly.

Why it matters:

If you lived in the home 2 out of the last 5 years, the law (Section 121) may allow a capital gains exclusion:

$250,000 (single)

$500,000 (married)

But if it’s not reported correctly, the IRS computer may treat the entire sale as taxable.

What it looks like:

A scary IRS letter that says you owe tens of thousands (or more) in tax, penalties, and interest.

The fix:

This is usually fixable—but it’s stressful, and completely avoidable with proper reporting.

✅ Takeaway: If you sold a home (especially one that was ever a rental), make sure your preparer understands Section 121 and how to report the sale correctly.

2) The Depreciation “Time Bomb”

This is the one that hurts landlords the most.

The mistake:

A preparer skips depreciation because it’s “complicated.”

They don’t want to:

allocate land vs building value

account for closing costs properly

classify improvements vs repairs correctly

So they simply… don’t depreciate.

Why it matters:

The tax code allows the IRS to recapture depreciation that was “allowed or allowable.”

Meaning:

When you sell, the IRS taxes you on depreciation whether you claimed it or not.

So if depreciation was skipped:

You lose years of deductions

You still pay tax as if you took them

And here’s the painful part:

you can generally only amend the last three years to recover missed deductions.

✅ Takeaway: Depreciation isn’t optional. If your rental has never been depreciated correctly, you may be sitting on a hidden tax problem.

3) The Repair Secret: The $2,500 Rule

Landlords do this every year: a unit turns over, and you spend real money getting it ready.

The problem:

The IRS often wants improvements depreciated over 27.5 years, which produces a tiny deduction each year.

The tool:

The De Minimis Safe Harbor (Treasury Reg. 1.263(a)-1(f))

This often allows you to expense individual items $2,500 or less immediately—if it’s handled correctly.

The strategy:

Don’t accept invoices that are bundled into one giant line item.

Instead of: “Flooring: $10,000”

Ask for: “100 boxes of flooring @ $100/box”

Why this matters:

One $10,000 item → depreciated

Many small items under $2,500 → may be deductible now

✅ Takeaway: The same renovation can produce totally different tax results depending on how it’s invoiced and categorized.

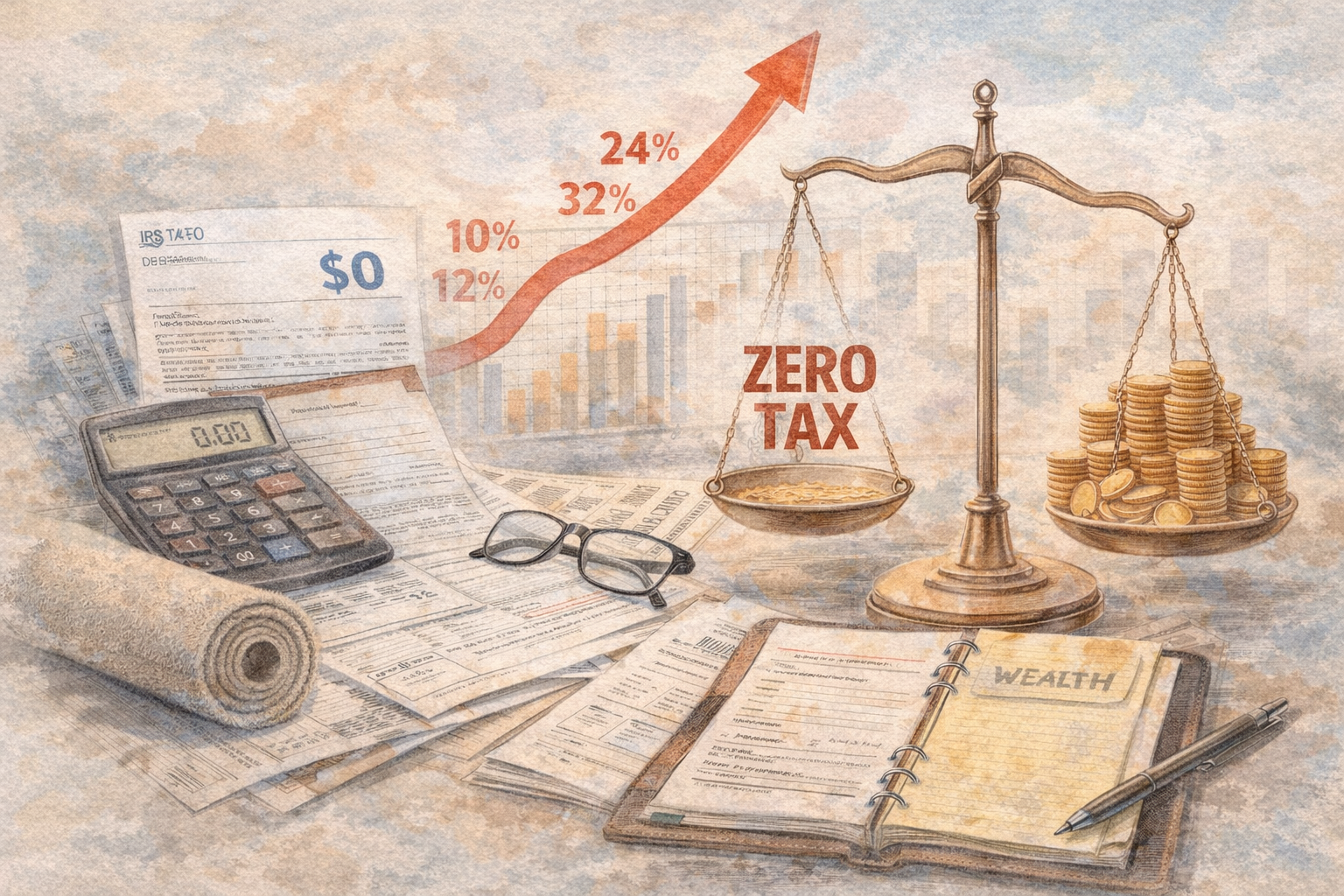

4) The Economist’s View: Don’t Go to Zero

Before law, I studied economics.

So when someone tells me:

“I paid zero taxes this year—I crushed it,”

I don’t automatically celebrate.

Sometimes “zero tax” is smart.

Other times it means you burned deductions at 10% or 12% that could have been worth 24% or 32% later.

For growing businesses and landlords, timing matters.

✅ Takeaway: Your goal isn’t a “perfect looking” return. Your goal is a smart return that keeps more wealth in your pocket over time.