The Hidden Tax Trap of 401(k) Withdrawals

Withdrawing money early from your 401(k) is usually a financial disaster. Once you add federal tax, the 10% penalty, and Massachusetts state tax, the real tax hit is often 37% or more. Before you tap into your retirement to buy a home or pay off debt, read this first.

Why I’m Writing This

In all my years as a tax attorney in Lowell, I have sent one mass email to my entire client list.

It wasn’t a holiday message.

It wasn’t a newsletter.

It was this warning.

Why? Because I keep seeing good, hardworking people destroy their long-term wealth after getting bad advice from an HR department or a 1-800 customer service line.

The conversation is always the same.

A client sits across from me in April.

I tell them they owe thousands in taxes.

They look shocked and say:

“But I already took the tax out. The lady on the phone said they withheld 20%.”

I hate delivering that news.

So let me explain it now — while you can still avoid the damage.

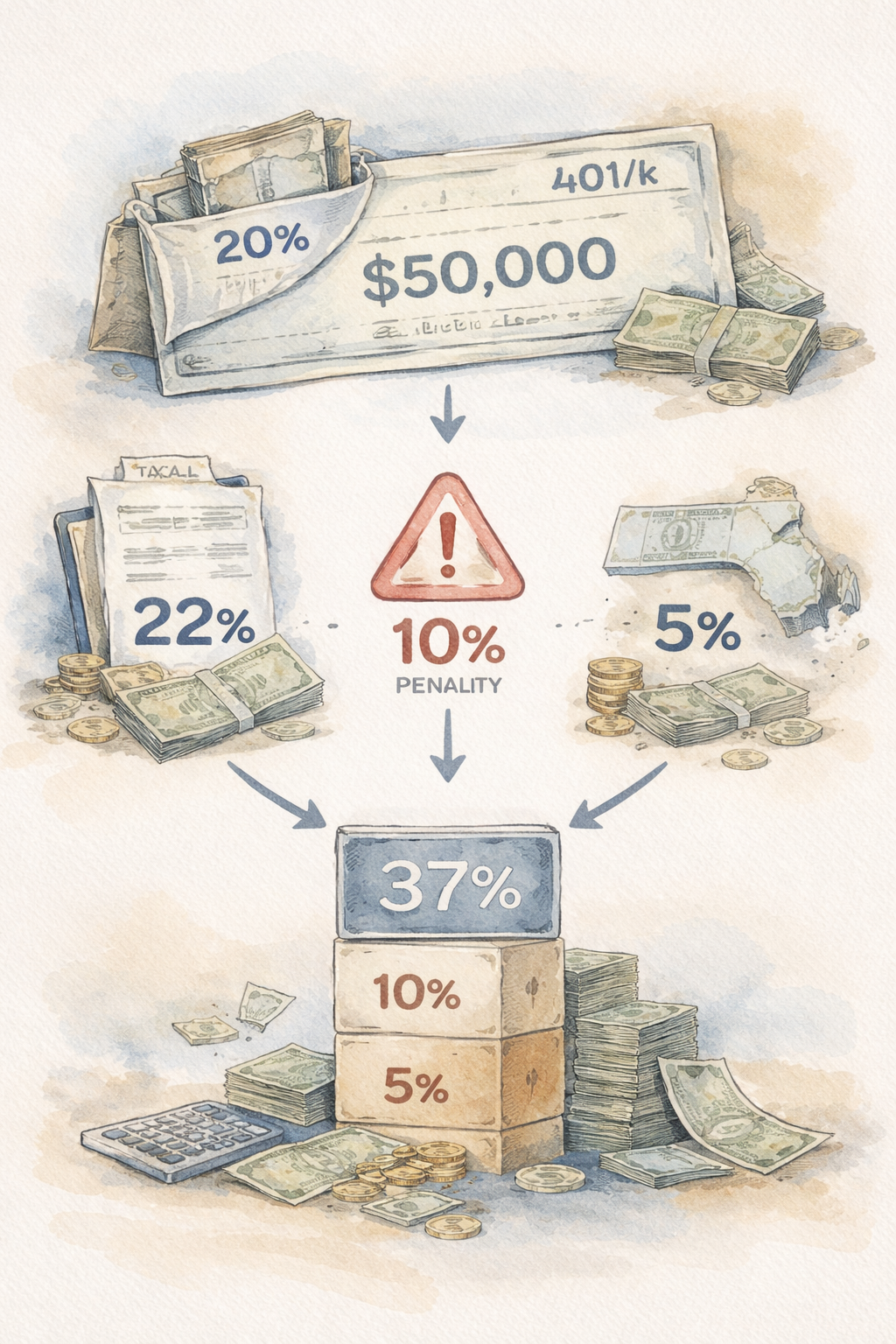

1. The Big Myth: “The 20% Withholding Covers It”

When you take an early 401(k) withdrawal, the plan administrator is required to withhold 20% for federal taxes.

Most people think that means:

“Taxes paid. Done.”

It is not done.

That 20% is just a down payment.

Here’s what’s missing:

Federal Income Tax

If you’re still working, adding a $50,000 withdrawal on top of your salary often pushes you into the 22% or 24% tax bracket. You’re already short.

The 10% Early Withdrawal Penalty

Unless you meet a very narrow exception, you owe this penalty — and the 20% withholding does not cover it.

The Massachusetts Surprise

Most 401(k) companies withhold nothing for Massachusetts.

Massachusetts still wants its 5%.

The Real Math

22% Federal tax

10% Penalty

5% Massachusetts tax

= 37% total tax rate (often higher)

They withheld 20%.

You owe around 37%.

Come April, I’m the one who has to tell you about the gap.

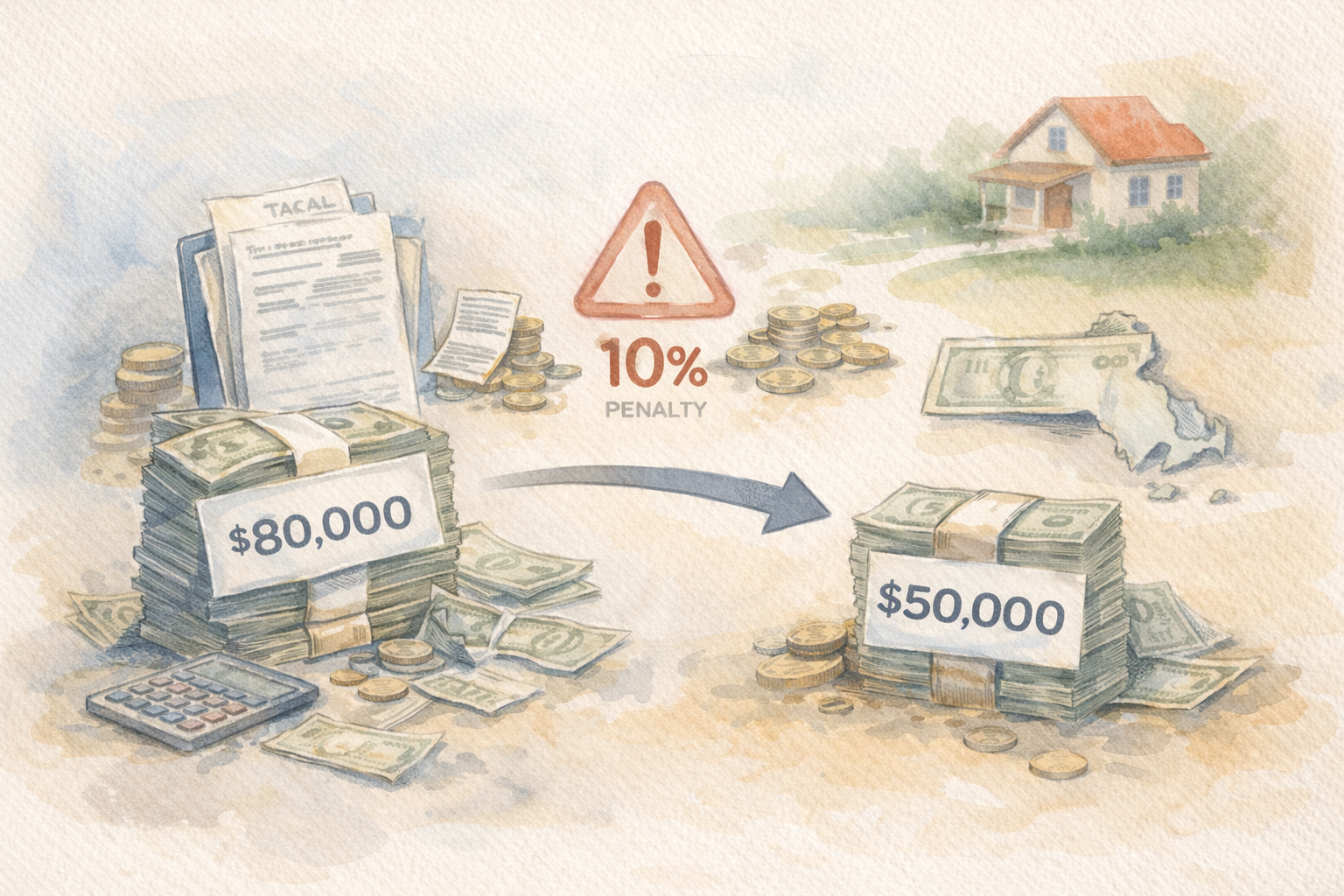

2. The Down Payment Disaster

($80,000 Gone to Get $50,000)

I see this constantly.

A young couple wants to buy a home in the Merrimack Valley.

They need $50,000 for a down payment.

They withdraw $50,000 from their 401(k).

Here’s what happens:

Taxes and penalties come to roughly $18,500

To actually net $50,000 in cash, they have to withdraw close to $80,000

That’s $80,000 of hard-earned retirement savings gone — instantly.

Retirement planners hate this.

And for good reason: you’re burning decades of compounded growth just to get cash today.

A Smarter Alternative: The “Dad Loan”

I once ran these numbers with a young client and his father.

When the father realized his son was about to lose $30,000 just to access his own money, he immediately offered a small family loan to bridge the gap.

The son hadn’t asked because asking family for help feels uncomfortable.

Withdrawing from a 401(k) feels “easy.”

Don’t do the easy thing.

Do the smart thing.

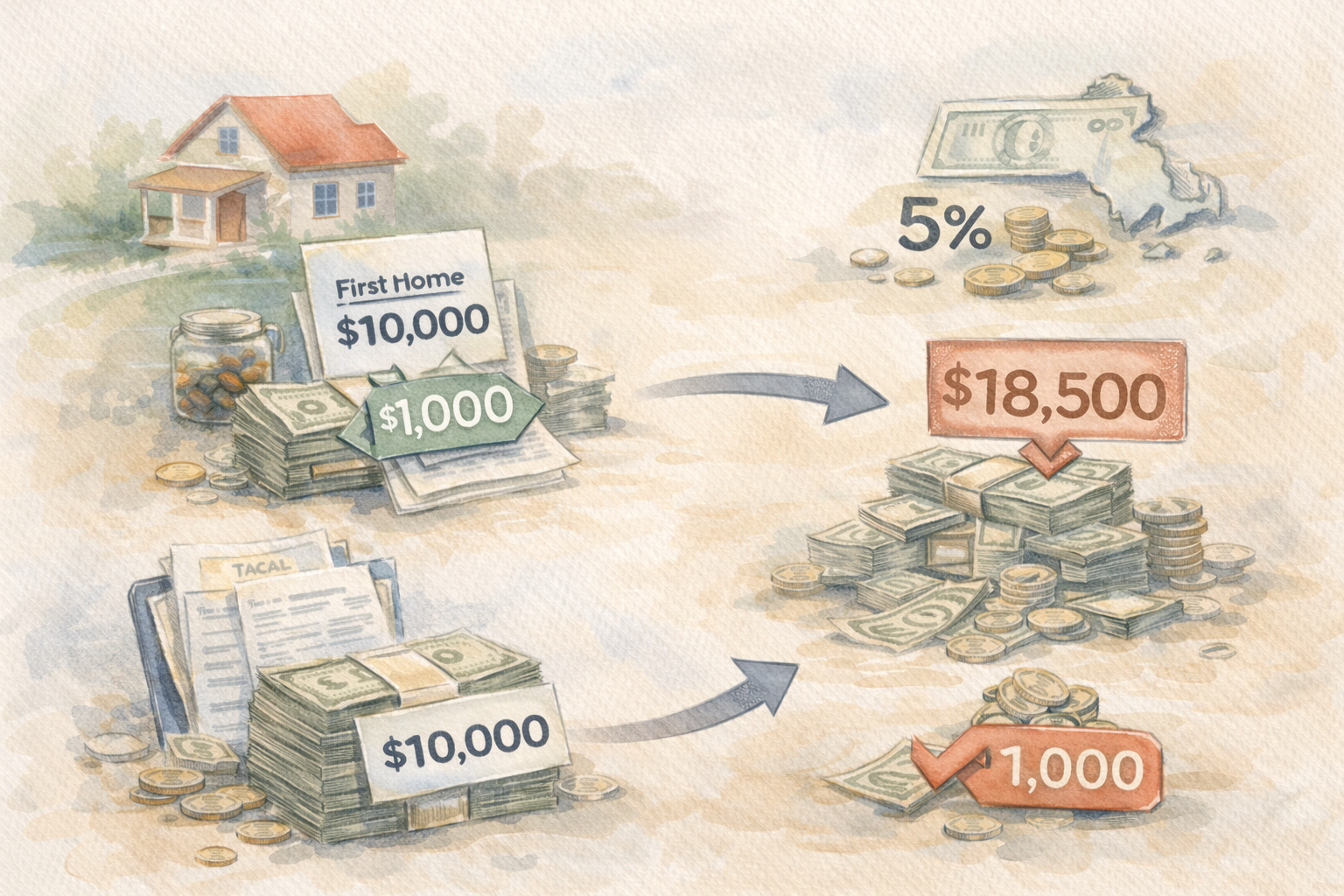

3. The “First-Time Homebuyer” Myth

This one drives me crazy.

Many people believe that withdrawing from a 401(k) to buy their first home is tax-free.

It is not.

You still owe income tax.

Some people think it’s at least penalty-free.

Also not true.

There is a first-time homebuyer penalty exception — but it’s capped at $10,000.

That saves you $1,000.

Nothing wrong with saving $1,000.

But when the total tax bill is $18,500, that’s not exactly a great deal.

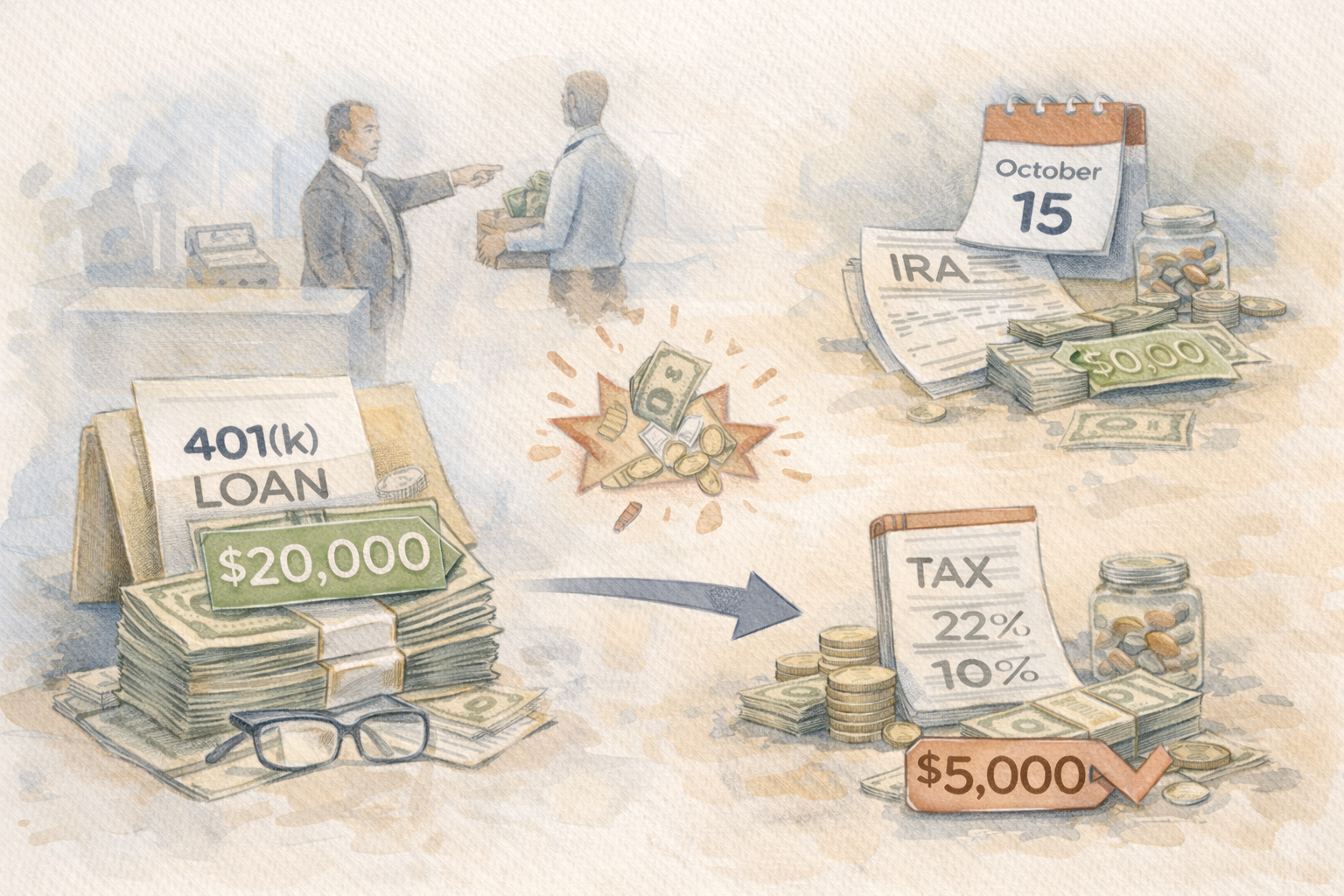

4. The Job-Change Trap

When a 401(k) Loan Explodes 💣

Many people try to be smart and take a 401(k) loan instead of a withdrawal.

That can be a good strategy — until you leave your job.

If you quit or get fired, the loan often becomes due almost immediately.

If you can’t repay it, the entire balance turns into a taxable distribution 💥

That means:

Income tax

Possible penalties

A surprise bill you weren’t planning for

The October 15th Escape Hatch 🗓️

If this happened to you, don’t panic.

You still have time to fix it.

If you left your job in 2025, you generally have until October 15, 2026 to roll over the loan offset amount into an IRA.

The Key Point Most People Miss ❗

This is not an all-or-nothing situation.

If your loan was $20,000 and you can only come up with $5,000, roll over the $5,000.

✅ You avoid taxes and penalties on that portion.

Every dollar you roll over reduces the damage.

I’ve seen clients save thousands of dollars by scraping together even a small amount once they understood the math.