The IRS Audit Trap Behind Dependent Credits and Head of Household

A Document Today Keeps the IRS Away:

Why I Ask for “Proof of Residency”

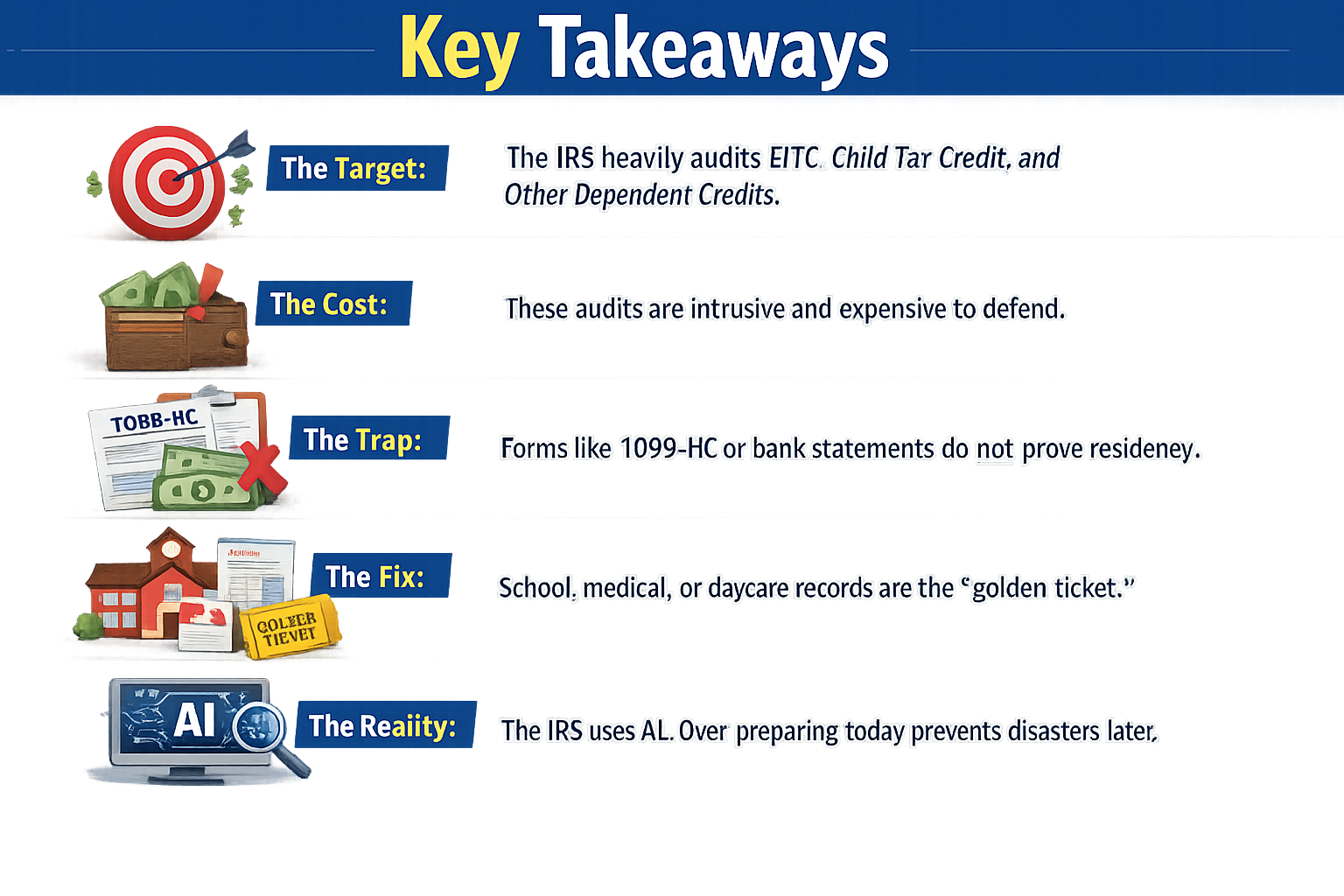

The IRS aggressively audits Earned Income Credit, Child Tax Credit, Other Dependent Credit, and Head of Household claims because they are easy targets. If your tax preparer checks the box saying “No documents provided,” they are painting a target on your back. I ask for report cards and medical records not to be difficult—but to protect you from an intrusive, expensive audit later.

Why the IRS Loves Dependent Credit Audits

Over half of IRS audits today are triggered by dependent-related credits, including:

Earned Income Credit (EITC)

Child Tax Credit

Other Dependent Credit

Head of Household filing status

These are “low-hanging fruit” for IRS computers. The audits are easy to start, highly automated, and extremely unpleasant for taxpayers.

The IRS sends a pre-packaged letter demanding proof of residency and support. For most people, it’s overwhelming.

The “Royal Pain in the Neck” (And What That Means for Your Wallet)

When a lawyer says something is a “royal pain in the neck,” that’s a polite way of saying:

It’s expensive.

In a dependent credit audit, the IRS doesn’t just want a birth certificate. They often ask for:

Cancelled checks showing you paid for food

Debit or credit card statements for clothing and necessities

School records

Medical records

Letters from landlords or caretakers

If you hire me to defend you at this stage, I have to charge for the hours it takes to gather, organize, and argue over this mountain of paperwork. You end up paying significant legal fees to fix a problem that one document could have prevented.

The “Lazy Preparer” Trap: “No Documents Provided”

For more than a decade, the IRS has required paid preparers to complete a Due Diligence Form (Form 8867). We must list exactly what documents we reviewed to prove a child lived with you.

Many “plain vanilla” preparers cut corners. They leave the box blank—or worse, they check “No documents provided.”

They think they’re helping you by not asking questions.

They’re not.

By filing that return, they are effectively telling the IRS:

“I claimed this credit, but I have no proof other than my client’s word.”

That is a red flag. It practically invites an audit.

The “Fake Proof” Trap: Why Some Documents Don’t Work

In Massachusetts, clients often bring forms they think prove residency—but don’t.

1099-HC (RomneyCare / MassHealth):

This proves insurance coverage, not residency. A non-custodial parent can insure a child.

Bank Statements:

You can open a bank account for a child and mail statements anywhere. The IRS knows this.

If you hand me these and say, “See? It has the address,” I have to tell you the truth:

It’s not enough.

Why I Am Strict About Documents

I am a trial lawyer. I resent having to “audit” my own clients—it shouldn’t be my job.

But I do it because I’m protecting you.

The IRS is aggressively shifting to Artificial Intelligence. Old shortcuts no longer work. Generic descriptions that passed years ago will not survive future audits.

The IRS can audit returns up to three years later. That means a return filed today may be reviewed by a much smarter system years from now.

If I don’t document your file with real proof—like a school record, daycare statement, or medical bill—I’m leaving you exposed.

A Simple Warning

If you come to my office and say,

“I don’t want to go home and get the report card,”

I will still file your return.

But I will document that I warned you.

And if an audit letter arrives later, I will remind you why I asked for those documents in the first place.

Don’t Let It Happen

Bring the report card.

Bring the vaccination record.

Bring the letter from the school or daycare.

It takes five minutes to find a document today, and it can keep the IRS away tomorrow.